KYC software for Dubai and the UAE

OneApprove™ is the leading KYC compliance platform in Dubai and the UAE. Automate client onboarding, identity verification, and AML screening for banks, wealth management firms, and real estate brokerages.

End-to-end KYC compliance in Dubai.

Zero friction.

OneApprove™ is KYC software built specifically for Dubai and the UAE. Automate the entire client verification lifecycle — from initial identity checks through ongoing AML monitoring — so your business stays compliant with UAE regulations without slowing down.

Every step of KYC compliance in the UAE, automated

From identity verification to ongoing AML monitoring, OneApprove is the KYC software that handles the full compliance lifecycle for regulated businesses in Dubai and across the UAE.

Identity Verification

Automated ID validation with biometric matching, liveness detection, and document authentication.

Document Processing

AI-powered document extraction, classification, and verification — passports, Emirates IDs, trade licences, and more.

Risk Screening

Real-time screening against global sanctions lists, PEP databases, adverse media, and watchlists.

Ongoing Monitoring

Continuous screening and risk re-assessment of your entire client base. Get alerted the moment a risk profile changes.

Regulatory Reporting

Automated compliance reports aligned with UAE Central Bank, SCA, RERA, and international AML standards.

Client Onboarding

End-to-end digital onboarding flows that turn days of paperwork into minutes of seamless verification.

KYC software built for the UAE's regulated sectors

Banks

KYC software for banks in Dubai and the UAE. Full KYC/AML compliance for retail and corporate banking. Meet UAE Central Bank requirements with automated verification, risk scoring, and regulatory reporting.

- Customer due diligence (CDD & EDD)

- AML transaction monitoring

- Central Bank reporting automation

Wealth Management

KYC compliance for wealth management firms in the UAE. Streamline client onboarding for high-net-worth individuals. Source of wealth verification, beneficial ownership, and ongoing due diligence — all in one KYC platform.

- Source of wealth / funds verification

- Beneficial ownership identification

- SCA compliance automation

Real Estate Brokerages

KYC software for real estate brokerages in Dubai. Property transaction compliance made simple. Verify buyers, sellers, and beneficial owners in minutes — meeting RERA and AML requirements without slowing deals.

- Buyer/seller identity verification

- RERA compliance checks

- Transaction due diligence

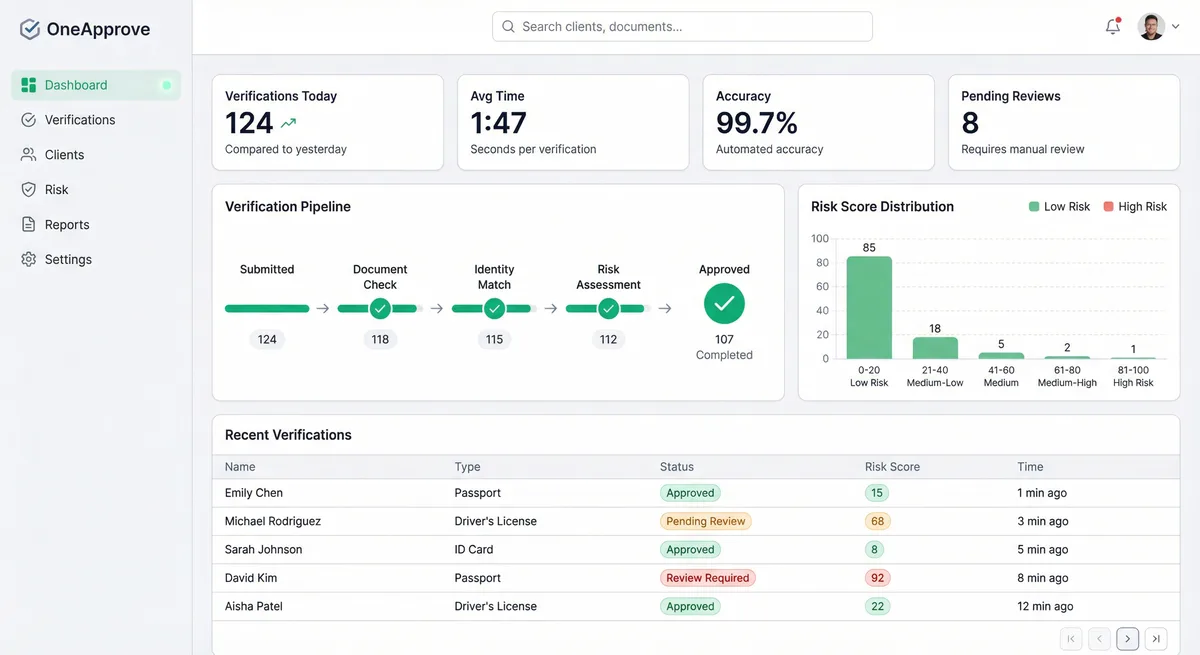

See OneApprove™ in action

Book a personalized demo and discover how regulated businesses across Dubai and the UAE are using OneApprove KYC software to transform their compliance operations.

Let's discuss your compliance needs

Our team specialises in KYC and regulatory compliance for the UAE market. Let's find the right solution for your business.